irvine ca income tax rate

Orange County sales tax. The combined Irvine sales tax is 775.

California Housing Market Report 2022

The December 2020 total local sales tax rate was also 7750.

. - Tax Rates can have a big impact when Comparing Cost of Living. This includes the following. Orange County sales tax.

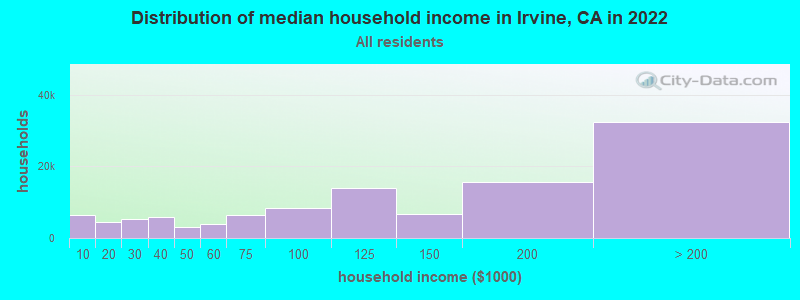

Income and Salaries for Irvine zip 92618 - The average income of a Irvine zip 92618 resident is 46989 a year. The state of Californias income tax rate is 1 to 123 the highest in the US. More about the California Income Tax.

More about the Pennsylvania Income Tax. Irvine city sales tax. California state sales tax.

- The Income Tax Rate for Irvine zip 92618 is 93. Tax amount varies by county. California state sales tax.

Irvine Sales Tax Rate. East Irvine Irvine 7750. California is known for high taxes and Irvine is no exception.

A combined city and county sales tax rate of 175 on top of Californias 6 base makes East Irvine Irvine one of the more expensive cities to shop in with 1117 out of 1782 cities having a sales tax rate this low or lower. Irvine Sales Tax Rate. The US average is 73.

Californias median income is 78973 per year so the median yearly property tax paid by California. There is an additional 1 tax on taxable income over 1 million for mental health services. 05 for Countywide Measure M Transportation Tax.

California has among the highest taxes in the nation. Its base sales tax rate of 725 is higher than that of any other state and its top marginal income tax rate of 133 is the highest state income tax rate in the country. East Lynwood Lynwood 10250.

School District Bond Rate. 30 rows - The Income Tax Rate for Irvine is 93. Use the Property Tax Allocation Guide.

A combined city and county sales tax rate of 175 on top of Californias 6 base makes University Park Irvine one of the more expensive cities to shop in with 1117 out of 1782 cities having a sales tax rate this low or lower. Pension Funding Liability - Funded Ratio. 10 rows Sales Tax.

When you add another 15 for local and district taxes the combined tax rate in Irvine CA is 775. School Bond information is located on your property tax bill. - Tax Rates can have a.

The state imposes a 6 sales tax rate and Orange County applies another 025. The US average is 46. The state of Californias income tax rate is 1 to 123 the highest in the US.

California has one of the highest average property tax rates in the country with only nine states levying higher property taxes. The state income tax rates range from 1 to 123 and the sales tax rate is 725 to 1075. East Palo Alto 9875.

The sales tax rate does not vary based on zip code. The Golden State fares slightly better where real estate is concerned though. East San Pedro Los Angeles 9500.

This includes the following. Within Irvine there are around 13 zip codes with the most populous zip code being 92620. Irvine city sales tax.

The combined Irvine sales tax is 775. This includes the rates on the state county city and special levels. The average cumulative sales tax rate in Irvine California is 775.

The US average is 28555 a year. Use the Property Tax Allocation Guide. Irvine City Sales Tax.

725 for State Sales and Use Tax. Cost Of Living In Irvine CA. See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Irvine CA.

The current total local sales tax rate in Irvine CA is 7750. The US average is 46. We have info about recent selling dates and prices property transfers and the top-rated tax rates near Irvine CA on our income tax rates directory.

Irvine is located within Orange County California. If you move from New York NY San Francisco CA or Washington DC the percent reduction of your cost of living could be -4350 -23 and -2010 thats good news to you that you could be looking at a positive net change in disposable income. The median property tax in California is 074 of a propertys assesed fair market value as property tax per year.

There is an additional 1 tax on taxable income over 1 million for mental health services. Orange County Sales Tax. Public Safety - 9548.

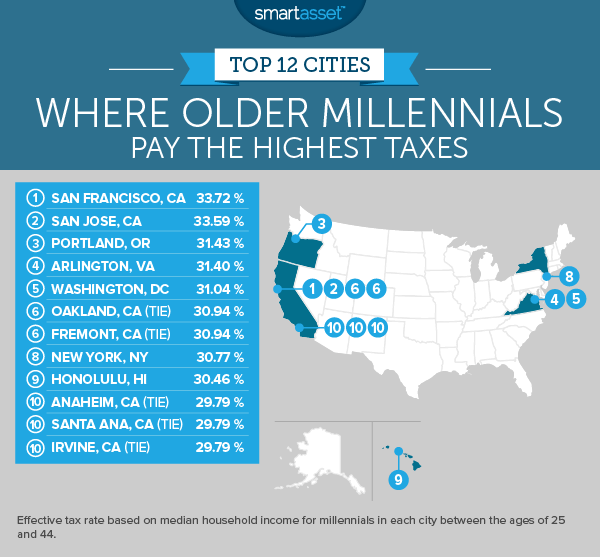

Where Millennials Pay The Highest Taxes 2017 Edition Smartasset

Orange County Ca Property Tax Calculator Smartasset

Understanding California S Property Taxes

Where Residents Are Most Likely To Pay State And Local Taxes Smartasset

Understanding California S Property Taxes

Understanding California S Property Taxes

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Understanding California S Property Taxes

California Provides Path To Deduct State Income Tax For Calculating Federal Tax Updated

What Are California S Income Tax Brackets Rjs Law Tax Attorney

How Is Rental Income Taxed In California

Irvine California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders